From zero to ESG

We guide businesses on their journey. "From zero to ESG, starting with foundational sustainability efforts and progressing toward full ESG integration. Our approach begins with a sustainability report, helping companies assess their environmental and social impact while aligning with industry best practices. From there, we build a structured ESG strategy, incorporating compliance, risk management, and value-driven initiatives. Through tailored solutions, regulatory insights, and financial impact assessments, we ensure that companies not only meet ESG expectations but also unlock long-term growth and competitiveness in a responsible, sustainable way.

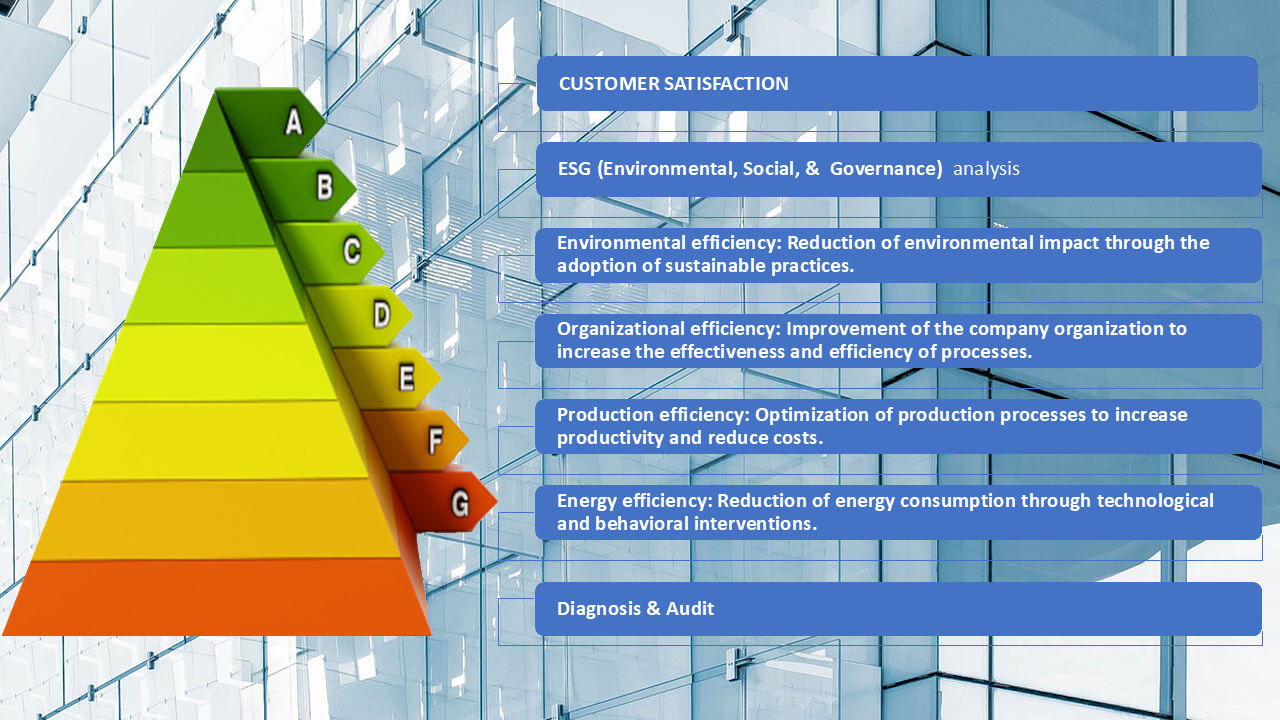

Energy efficiency is the ability of a system to obtain a given result thanks to the use of a smaller amount of energy, thus recording a better overall performance. This leads to two important results: less use of resources and greater energy savings. Therefore, energy efficiency expresses the ability of a certain system to optimize results with less expense. Italy and the European Union have long undertaken a path to make the economy more sustainable for the environment and for our planet, but the disruptions of the global energy market caused by ongoing conflicts have made it urgent to save energy, produce clean energy and diversify energy supplies. The ability of companies to be competitive in the presence of higher energy costs than in the past and in any case more variable, makes it urgent that the regional economic system participate and assume a leadership role in the accelerated process of decarbonization of the European and global economy.

FROM ZERO TO ESG: EVE CORPORATE FROM ZERO TO ESG is the dedicated network of companies focused on environmental progress, Social, and Governance (ESG) practices. These networks will provide a platform for businesses to connect, learn, and collaborate on sustainability initiatives. We aim to support companies at every stage of their ESG journey, from initial implementation to advanced strategies. Interested in joining or learning more? Comment below or send us a direct message

ESG fractional manager:

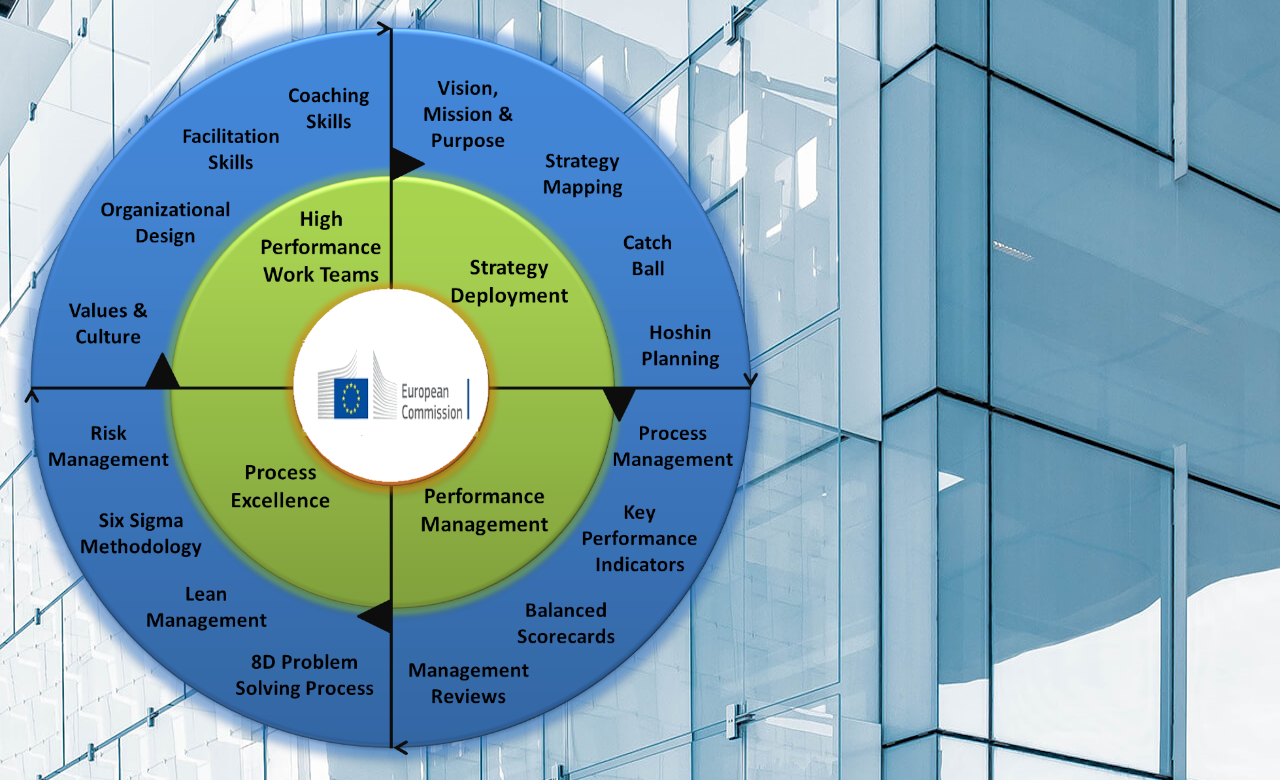

An ESG Fractional Manager service offers organizations the opportunity to access experienced Environmental, Social, and Governance professionals on a flexible basis, such as part-time, project-based, or interim engagements. This allows companies to benefit from specialized ESG knowledge and leadership without the need for a full-time hire. The core function of this service is to provide strategic guidance and operational support to integrate ESG principles throughout an organization's strategy, operations, and culture. Fractional managers help companies navigate the complexities of ESG regulations, reporting frameworks, and stakeholder expectations, ultimately driving the development and implementation of ESG initiatives that align with business objectives and foster long-term value creation. This service is particularly beneficial for organizations recognizing the growing importance of ESG but lacking internal expertise, those in the early stages of ESG development needing experienced leadership, companies requiring specific ESG skills for projects, those needing temporary ESG leadership, or organizations seeking an objective external perspective. Engaging a fractional manager offers several advantages, including access to seasoned professionals, cost-effectiveness by avoiding full-time overhead, flexibility in engagement, an unbiased external viewpoint, faster implementation of initiatives, specialized skills on demand, reduced risk through experienced guidance, and enhanced credibility in ESG commitment. The scope of services provided by an ESG fractional manager can be tailored to individual client needs, potentially encompassing ESG strategy development, materiality assessments, ESG risk and opportunity management, ESG reporting and disclosure, stakeholder engagement, ESG integration into operations, ESG training and awareness, performance measurement, benchmarking, support with ESG ratings, and the development of ESG policies and procedures. Ideal fractional managers possess a deep understanding of ESG principles, experience in strategy development, strong knowledge of reporting standards, excellent communication skills, analytical abilities, project management skills, industry-specific knowledge where relevant, and a commitment to ethical conduct. Ultimately, by utilizing an ESG fractional manager, organizations can effectively progress their ESG goals, improve their reputation, attract investors and talent, and contribute to a more sustainable future through a flexible and cost-efficient model.